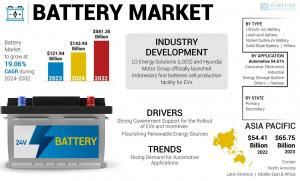

Battery Market to Reach USD 581.35 Billion by 2032, CAGR 19.06%

The global battery market, valued at USD 121.94 billion in 2023, is projected to expand significantly, reaching USD 581.35 billion by 2032, at a CAGR of 19.06%.

Asia Pacific dominated the battery market with a market share of 53.91% in 2023.”

PUNE, MAHARASHTRA, INDIA, September 25, 2025 /EINPresswire.com/ -- The battery industry is one of the fastest-growing segments in the global energy landscape. In 2023, the market was valued at USD 121.94 billion, rising to USD 143.94 billion in 2024, and is projected to exceed USD 581.35 billion by 2032. This growth reflects a robust 19.06% CAGR between 2024 and 2032.— Fortune Business Insights

Asia Pacific held a 53.91% share in 2023, dominating production and consumption, especially due to electric mobility adoption in China, India, and Japan. In parallel, the U.S. market is projected to reach USD 65.14 billion by 2032, supported by clean energy policies, supply chain development, and significant EV adoption.

Get a Free Sample PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/105615

Key Market Drivers

EV Expansion – Electric vehicle deployment rose by 40% in 2023, with 14 million EVs sold. Incentives such as the U.S. Inflation Reduction Act and subsidies in Europe and China fuel adoption.

Energy Storage Systems (ESS) – Batteries are critical in renewable integration, powering utility-scale grids, households, and decentralized mini-grids.

Government Support – Tax credits (up to USD 7,500 in the U.S.), rebates (e.g., California’s SGIP), and national clean energy policies stimulate adoption.

Cost Declines – Falling lithium-ion battery prices make EVs and storage solutions more affordable and competitive.

Hydrogen & P2G Synergy – Initiatives such as Denmark’s Green Hydrogen Hub highlight integration of batteries with renewable-powered hydrogen storage.

Market Trends

Lithium-ion Dominance – High energy density, low self-discharge, and wide temperature tolerance make lithium-ion the most widely used type.

Circular Economy – Increasing emphasis on recyclability and sustainable chemistries such as sodium-ion batteries.

Solid-State Batteries – Emerging single-layer and multi-layer variants promise higher safety, energy density, and lifespan.

Green Hydrogen Storage – Batteries are increasingly paired with hydrogen to overcome renewable intermittency challenges.

Automotive Leadership – EV and hybrid demand keep automotive applications at the forefront of battery use.

Challenges

The greatest challenge lies in raw material volatility, particularly in lithium, cobalt, nickel, and graphite markets. Sudden price fluctuations impact profitability and supply stability. Lithium price swings, for example, can increase production costs, making batteries less competitive. To overcome this, manufacturers are investing in supply chain diversification, recycling, and alternative chemistries to stabilize costs.

Have Any Query? Ask Our Experts: https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/105615

Market Segmentation

By Type

Lithium-Ion Batteries – Market leader, with up to 5x higher energy density than nickel-based batteries and operational flexibility from -50°C to 125°C.

Lead-Acid Batteries – Second largest segment, widely used in vehicles and electronics, with lifespans ranging from 3–12 years.

Nickel-Cadmium Batteries – Still relevant in select industrial applications.

Solid-State Batteries – Single and multi-layer versions gaining traction due to improved safety and energy efficiency.

Others – Includes emerging chemistries such as sodium-ion and zinc-air.

By State

Secondary (Rechargeable) Batteries dominate due to sustainability, reusability, and long-term cost savings.

Primary (Single-use) Batteries remain significant in applications requiring convenience and low upfront costs.

By Application

Automotive – Largest end-use segment, driven by EV adoption, stricter emissions laws, and government incentives.

Consumer Electronics – Rapid growth fueled by demand for smartphones, laptops, and portable devices.

Energy Storage Systems – Increasing adoption for renewable integration and grid balancing.

Industrial & Railway – Steady demand from backup power and specialized transport uses.

Others – Includes defense, marine, and small-scale applications.

Regional Outlook

Asia Pacific (USD 65.75 billion in 2023) – Dominates due to EV production, strong consumer electronics demand, and favorable industrial growth in China, India, and Japan.

North America – Bolstered by U.S. Department of Energy’s USD 2.8 billion funding in raw material processing and over USD 40 billion in EV battery plant investments.

Europe – Rapid adoption supported by hydrogen and fuel cell R&D, especially in Germany, U.K., and France.

Latin America – Growth centered in Brazil and Mexico with EV adoption and renewable integration.

Middle East & Africa – Investments in clean energy diversification and grid storage expansion.

Get a Free Sample PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/105615

Key Industry Players

The market is highly fragmented, with both global leaders and regional firms. Key players include:

CATL (China)

LG Energy Solution (South Korea)

Panasonic (Japan)

BYD (China)

Samsung SDI (South Korea)

SK Innovation (South Korea)

Gotion (China)

EVE Energy Co. Ltd (China)

Sunwoda Electronics (China)

Exide Industries Ltd (India)

Recent Developments

July 2024 – CATL launched its TIANXING EV battery brand with fast-charging and long-range solutions.

July 2024 – LG Energy Solution & Hyundai opened Indonesia’s first 10 GWh EV battery plant.

April 2024 – CATL introduced Shenxing PLUS LFP battery, exceeding 1,000 km range with 4C charging.

March 2024 – Panasonic partnered with Indian Oil Corporation to establish cylindrical battery production in India.

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.